This personal finances tracker for Google Sheets is my secret for keeping track of all of my family’s income, spending, and monthly bills in about 5 minutes a day! A game changer for your budget!

I may not be good at preparing gourmet home-cooked meals and my clean laundry may sit in the dryer for 4 days before I remember to fold it, but when it comes to my family’s personal finances and keeping track of income and expenses, I ROCK!

I’ve been managing ALL of the finances for my family for over 15 years, and when I say “all”, I mean that my husband doesn’t even know the name of our mortgage company – that’s the reason why I made this amazing Emergency Binder so that he isn’t completely lost if something ever happens to me.

And over the last decade, I’ve tried a TON of different ways to keep track of monthly bills, daily expenses and spending, and income.

For many years, I used this daily planner method for money tracking, but then I decided to use the magical powers of automatic spreadsheet calculations and formulas, and I created a budget tracker spreadsheet that I absolutely LOVE! I’ve been using this spreadsheet template for over 3 years now, and it has completely changed how I manage our finances, making it easier to see what spending categories encompass the largest part of our budget and how much money we make each month, down to the penny… and I can access ALL of our budget data for the last 3 years in about 60 seconds flat.

It doesn’t get much easier than that! (Even if you’re not a super tech-y spreadsheet person!)

If you’re tired of watching your bank balance dwindle, and you know that you really need to start tracking daily expenses and spending, then this is the money tracker spreadsheet for you!

Here’s everything you need to know about my #1, go-to, recommend to everyone method for keeping track of income, monthly bills, and spending:

What I LOVE About this Income and Expense Tracker for Google Sheets

Nothing is more motivating than opening up a Google Sheets spreadsheet and checking to see how much money that you’ve saved year to date… at least that’s been my experience over the last 3 years.

Here are some other reasons why I LOVE and highly recommend this personal expenses spreadsheet tracker:

Easy to Use

One of the greatest things about my daily expense tracker, which I call “The Master Money Tracker”, is how easy it is to use!

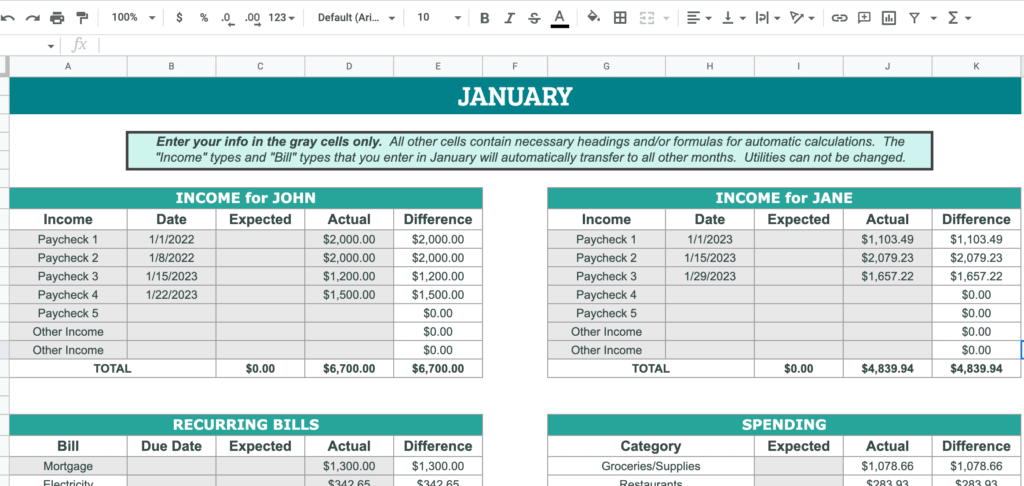

The spreadsheet was designed to be very user-friendly, even for the most tech-challenged people. The cells (or boxes in the spreadsheet) are color-coded so you know where to type in your info. You only need to enter information in the GRAY cells! All of the other cells contain important formulas and headings that are required for the spreadsheet to calculate your information properly.

The Summary Sheets

The Summary sheets are provided to give you a snapshot of your finances, Year to Date. You do NOT need to enter any information in these sheets, because all of the calculations are already done for you based on the income, expenses, and transactions entered in your Monthly sheets.

There are 5 different “Summary” sheets in the money tracker spreadsheet, and all of the data in these sheets is automatically added based on the info you enter in the monthly sheets:

- YTD Financial Summary

- Income Summary

- Monthly Bills Summary

- Utilities Summary

- Monthly Spending Summary

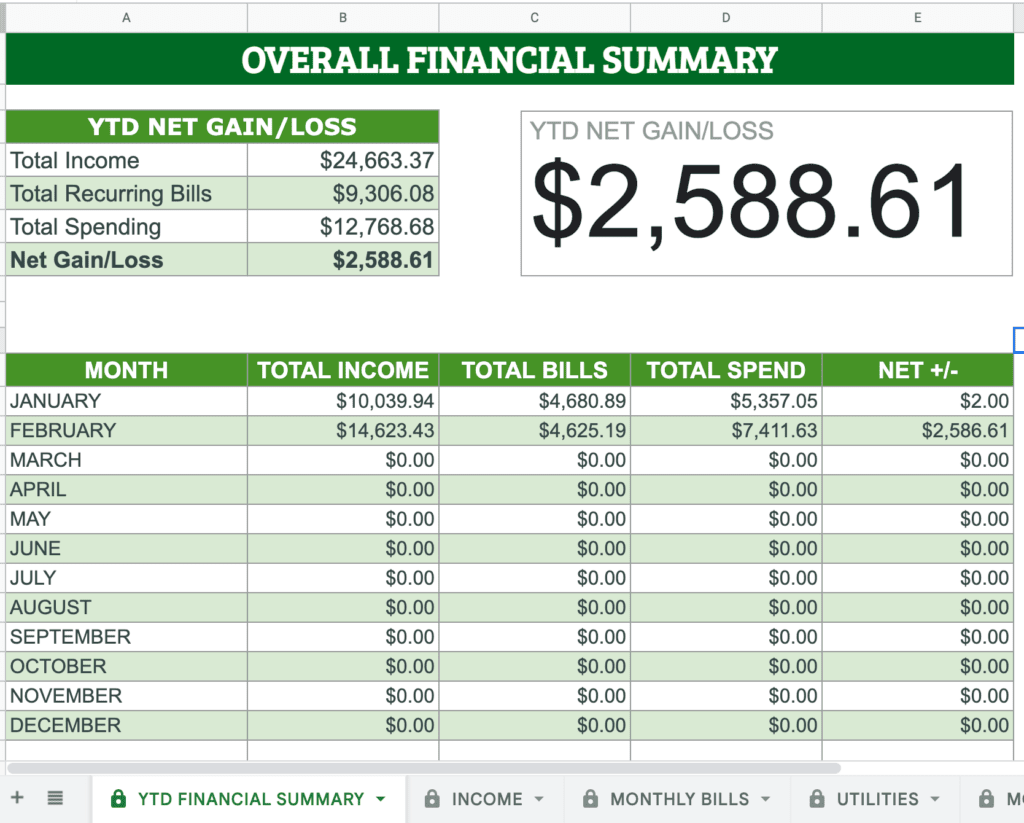

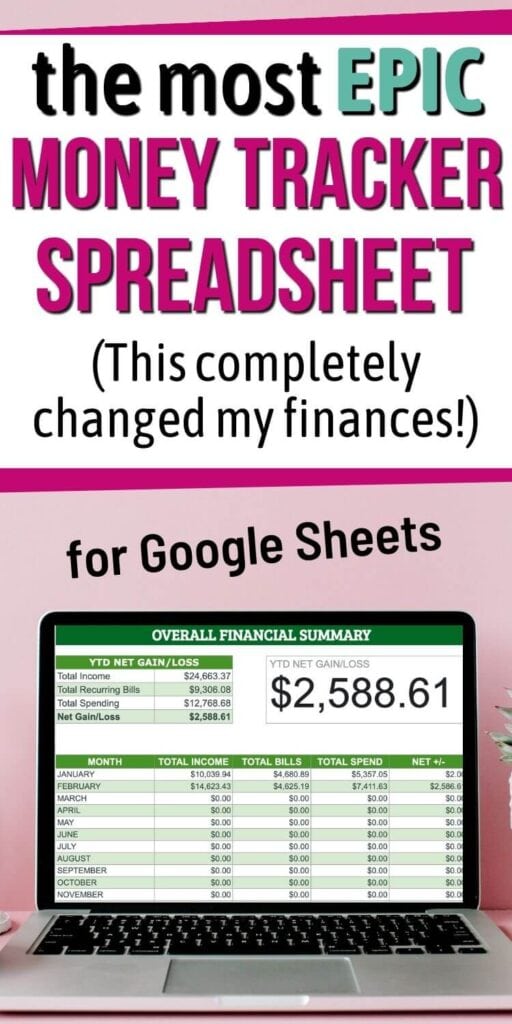

So you get at-a-glance tables and graphs like this that you can reference at any time to see how you’re doing year to date, and you don’t have to enter a single thing in these summary sheets! Here’s an example of the Year-to-Date Overall Financial Summary sheet:

I reference this sheet ALL the time to see how much money that our family has saved so far for the year. And you can also see your total income, total monthly bills, and total spending from this sheet also.

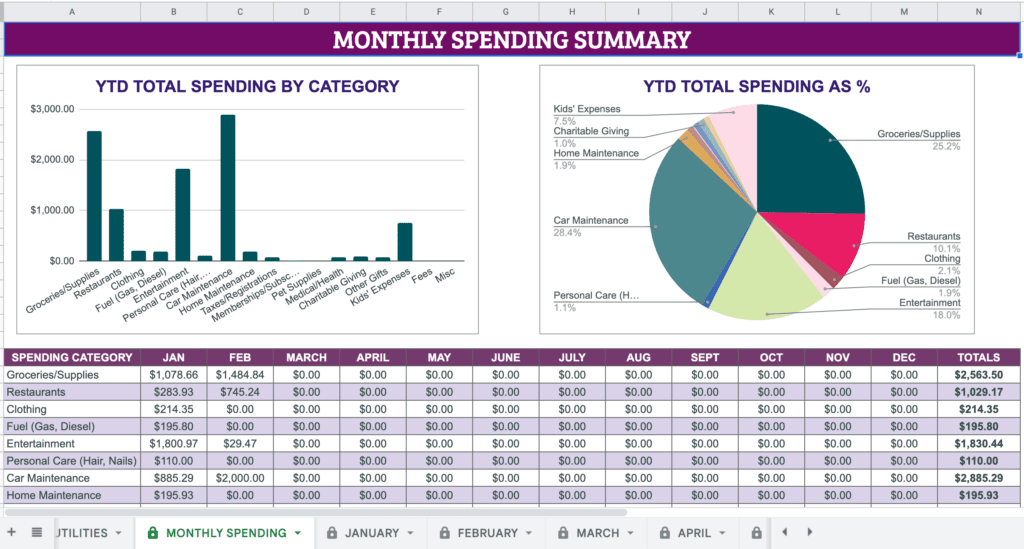

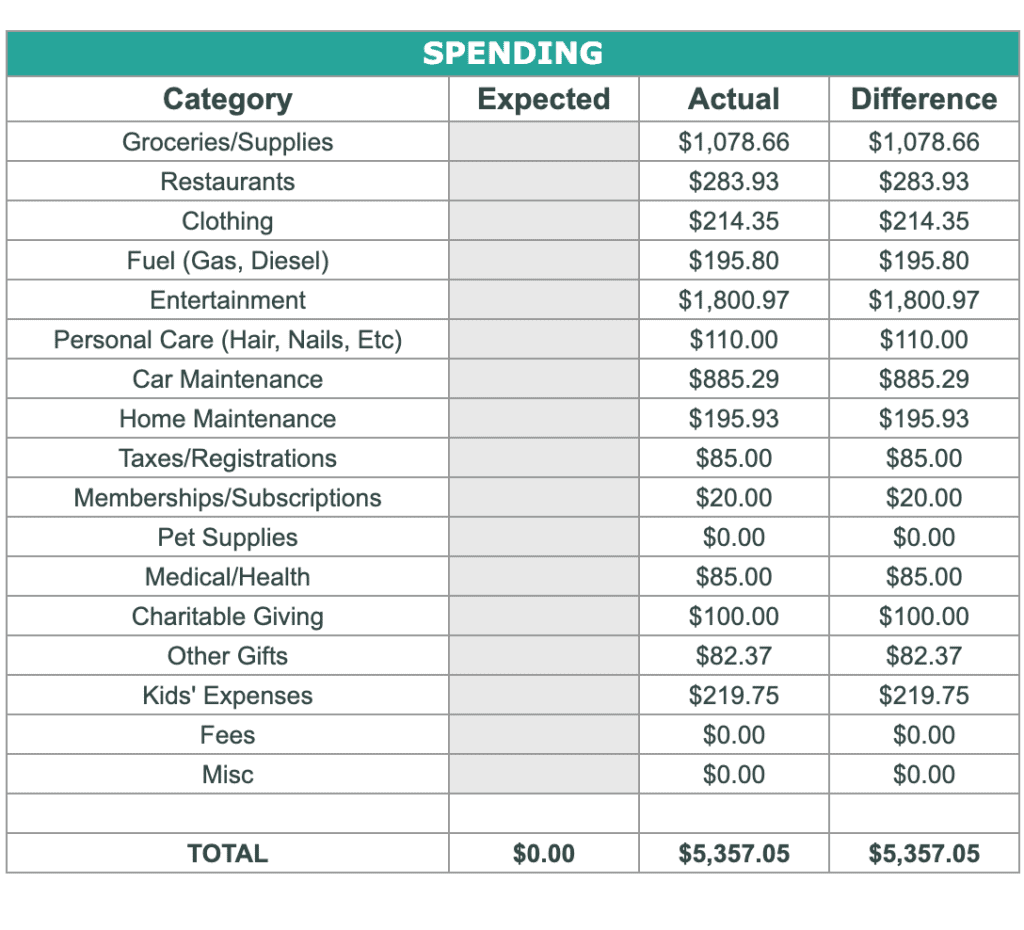

And here is the Monthly Spending Summary sheet… All of the data on this spreadsheet is automatically transferred in from the spending transactions that you enter on the monthly sheets:

Monthly and Year-to-Date Calculations

I prefer to keep track of my income and expenses on a monthly basis, but I also like to know how we’re doing financially year to date… and this money tracker spreadsheet makes it easy to do both!

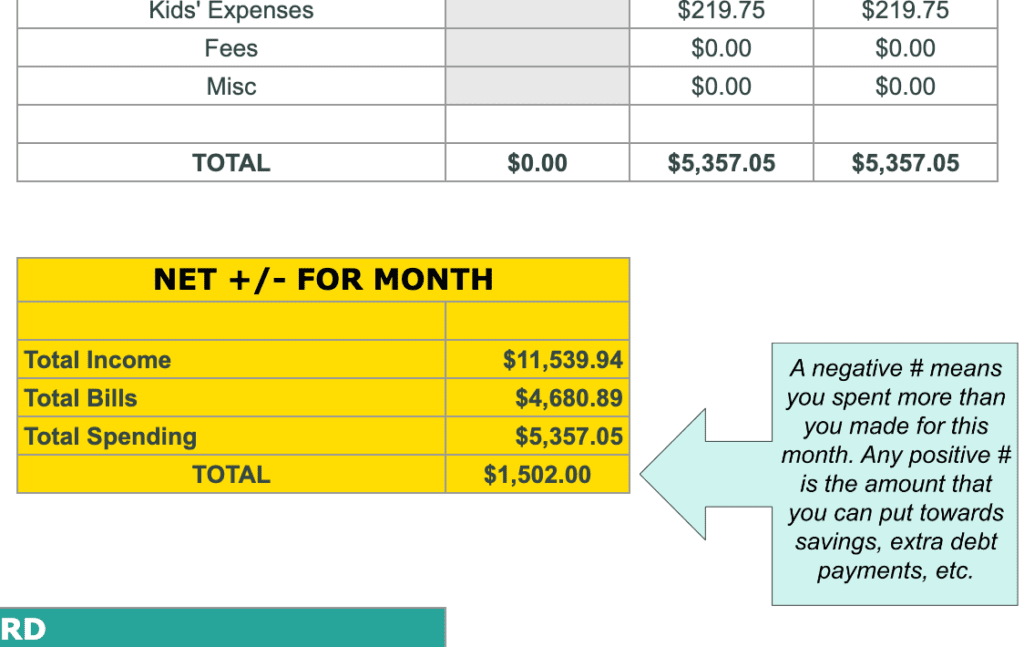

The Overall Financial Summary sheet gives you a year-to-date snapshot of your net gain or loss (whether you’re saving money or spending more than you bring in). And each monthly sheet tells you how you did for that month.

I frequently refer to both the monthly totals and the year-to-date net to make sure that we’re saving a comfortable amount of money each month and we’re not spending more than we make without realizing it.

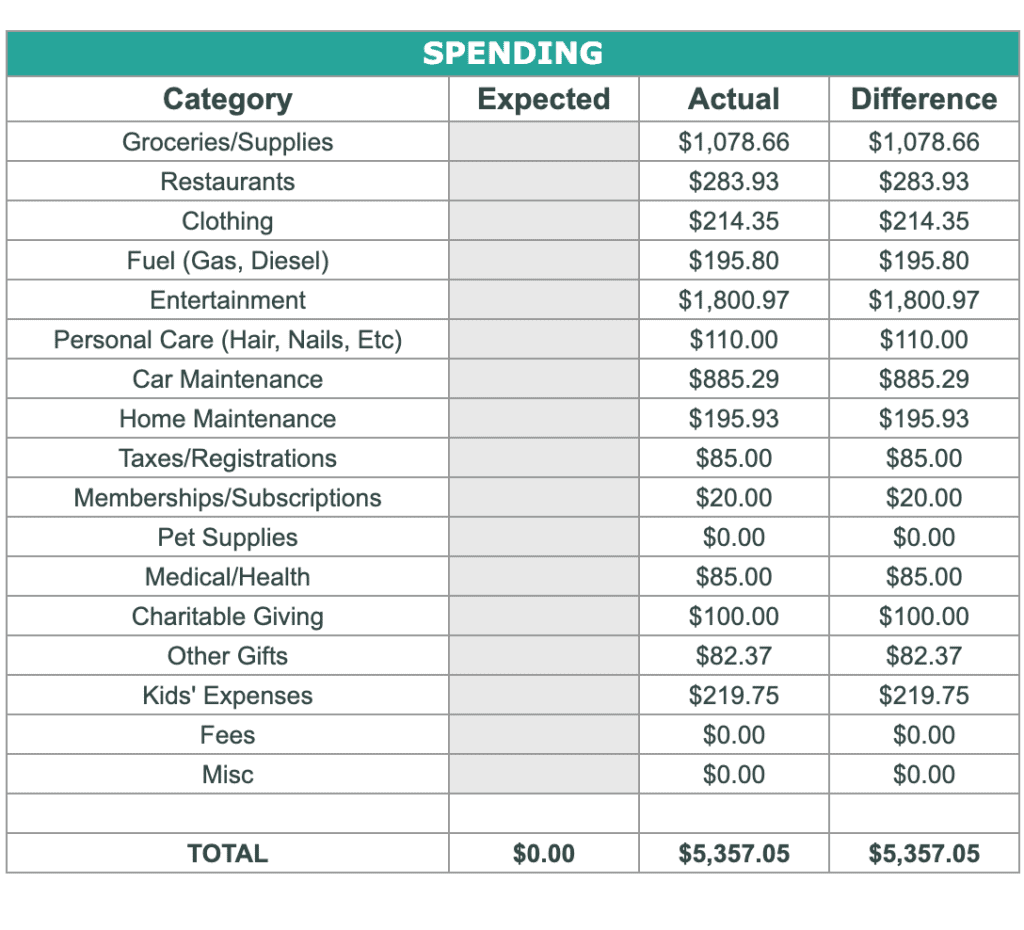

All Spending Categories are Calculated Automatically

Want to know how much money you spent at restaurants during the month of March? Or how about how much you spent on gas for the year? You can easily find out in less than a minute!

As you’re entering in your daily spending transactions, you’ll select a category for each from a drop down menu. Then, all of the transactions for each category are calculated automatically. You’ll be able to see a running total of your spending for each category in a separate table here:

I used to do all of these calculations by hand at the end of each month, but the spreadsheet budget tracker makes it so much easier!

What to Include in Your Google Sheets Budget Tracker Spreadsheet

To get a full picture of your financial health each month and year to date, I recommend that you include ALL balance-affecting transactions, meaning if a transaction changes your bank balance (either positively or negatively) you include it on your spreadsheet.

Besides normal monthly bills like your mortgage payment and cell phone bill, you should also include daily spending on things like groceries, restaurants, clothing, subscriptions, and medical expenses. Here are some ideas for things to include in your personal finances tracker:

Income

In order to see your total net gain or loss for each month, you’ll need to keep track of all of the income that you and your spouse bring in.

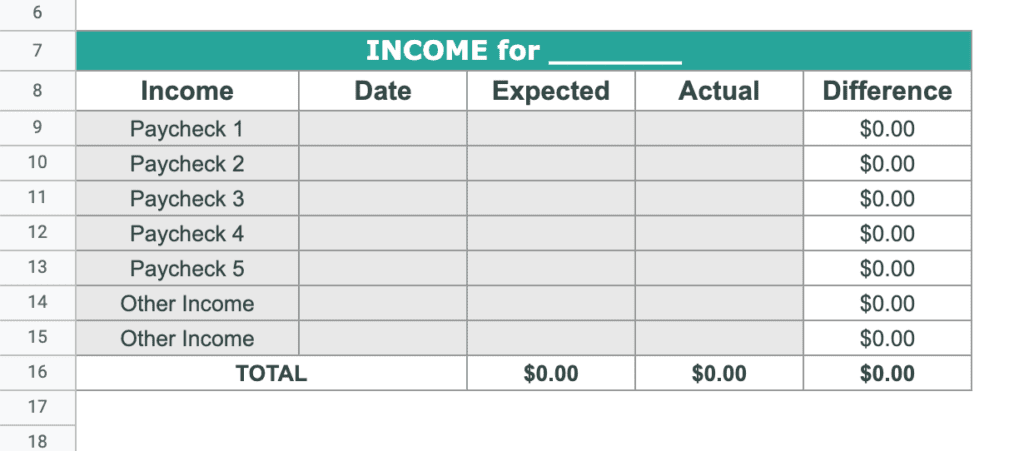

The spreadsheet includes two tables at the top of each monthly sheet where you can enter up to 7 different income amounts for each person, each month:

Income examples to include are:

- Paychecks

- Bank deposits from odd jobs or gig work – Like driving for Door Dash or Uber

- Interest income – Like from high yield savings accounts

- Stock dividends

- Alimony or child support payments that you receive

- Social security payments that you receive

- Pension payments

- Rental income

- Income from selling personal items – Like selling household items on Facebook Marketplace, Ebay, etc. or garage sales

*NOTE – You can change the names of the income types listed on the January sheet, and the changes that you make will automatically transfer to all the other monthly sheets. For that reason, I recommend that you keep 1 or 2 “Other Income” or “Misc Income” spaces to record income that may not be consistent throughout the year.

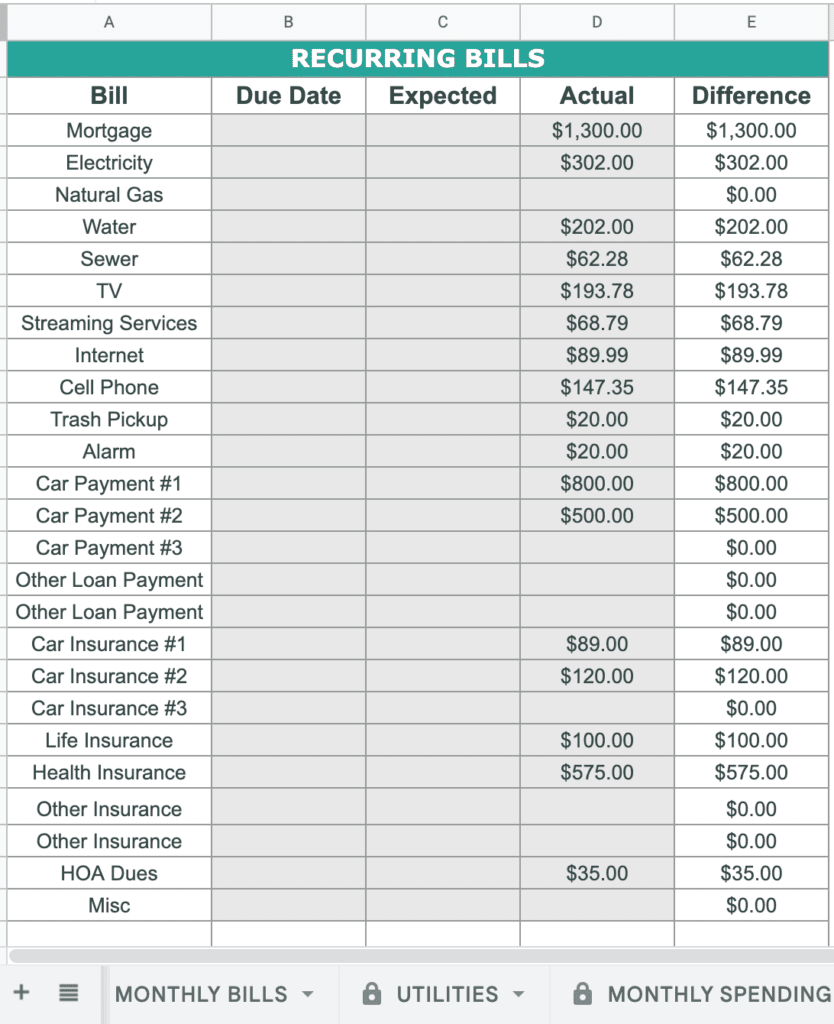

Monthly Bills

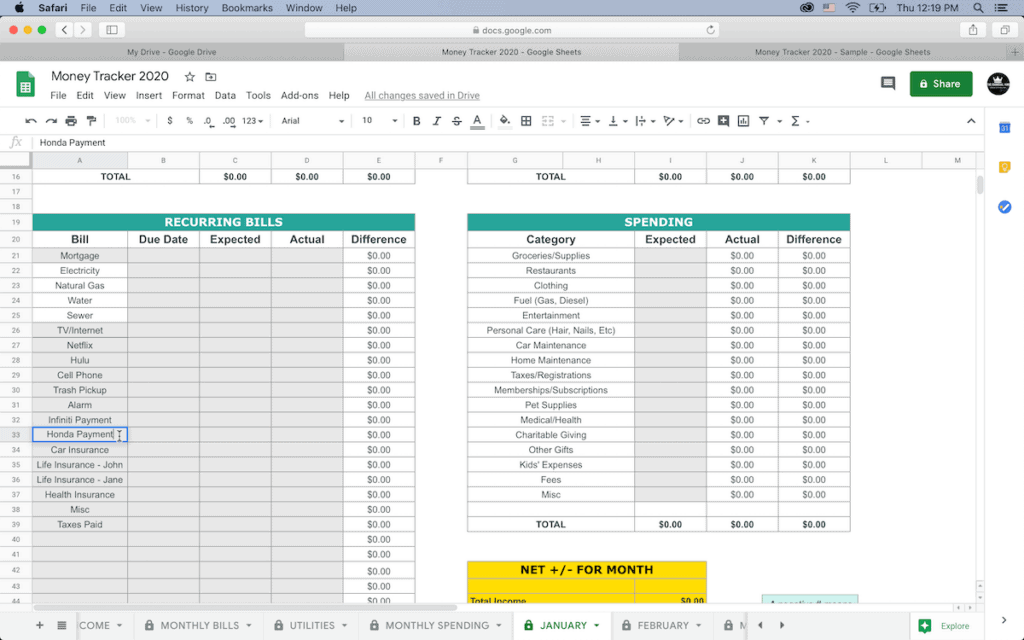

Right below the income tables in the spreadsheet, you’ll find a table labeled “Recurring Bills” like this:

The money tracker spreadsheet comes pre-filled with these monthly recurring bills, but you can easily change them to suit your needs:

- Mortgage

- Electricity

- Natural gas

- Water

- Sewer

- TV

- Streaming services

- Internet

- Cell phone

- Trash pickup

- Alarm

- Car payment – space for 3 different auto loans

- Other loan payment – space for 2 other loans

- Car insurance – space for 3 different auto insurance payments

- Life insurance

- Health insurance

- Other insurance – space for 2 other insurance bills

- HOA fees

- Misc

*These are just the monthly bills that come pre-filled on the spreadsheet… You can change any of the names, other than the utilities bills (electricity, water, sewer, natural gas) which are tied to the Utilities Summary sheet.

Daily Spending

Entering in your daily spending is probably the most time consuming task, but it’s also super important because many people have no idea how much they are spending on little odds and ends, like their daily gas station coffee. And your daily spending (anything that’s not a regular monthly bill) probably encompasses a large percentage of the total money that you spend each month.

Just think about how many transactions you have on the average day – it’s probably anywhere between 5-15 transactions for things like gas, drive-thru breakfast, lunch, groceries, random household necessities, etc.

Here are the spending categories that come in my personal expense tracker:

- Groceries/Supplies

- Restaurants

- Clothing

- Fuel (Gas, diesel)

- Entertainment

- Personal Care (Hair, nails, etc)

- Car Maintenance

- Home Maintenance

- Fees

- Taxes/Registrations

- Memberships/Subscriptions

- Pet Supplies

- Medical/Health

- Charitable Giving

- Other Gifts

- Kids’ Expenses

- Misc

For each spending transaction that you enter, you’ll select from these categories in a drop down menu. The spreadsheet then keeps a running total of each category for each month. Want to see how much you’ve spent eating out at restaurants month to date? No problem!

Recording Credit Card Transactions

When recording your credit card transactions, you need to take care to not record the same transaction twice. This is how I personally use the income and expense tracker to record every penny of my family’s finances:

Every 2-3 days, I open the app for our first credit card and I add all of the expenses/spending to the spreadsheet in the appropriate columns – So for instance, our electric bill is automatically charged to our credit card, so I would put that charge under “Electricity” under Recurring Bills.

Most of the credit card charges though are “Daily Spending” (things like restaurants, groceries, etc). I just add those in date order to the Detailed Spending Transaction Record table, and categorize them with the drop down menu. Then, I open up my next credit card app and add those transactions from the previous 2-3 days to the spreadsheet as well. Then, I move on to our personal bank account app and add all of those transactions to the sheet also.

Since I do pay off our credit cards completely every week, I use the transactions list in my credit card apps and enter all of the transactions from there… Then, when the payment for the credit cards comes out of my bank account, I DON’T enter that payment because the transactions have already been recorded… If I were to record the actual credit card payment AND the individual charges on the credit cards, then that would be counted twice.

*You can find more detailed tips for keeping track of income and expenses here!

If you DO carry a balance on your credit cards, then you’ll need to record the interest portion of your payment each month. Here are two good options for keeping track of the interest expense:

- Make one of your monthly bills named “Credit Card Interest” and add the interest charge from your credit card statement each month.

- If you have multiple credit cards that you pay interest on, record the interest portion for each card in the Spending Transactions Record and categorize as “Fees”.

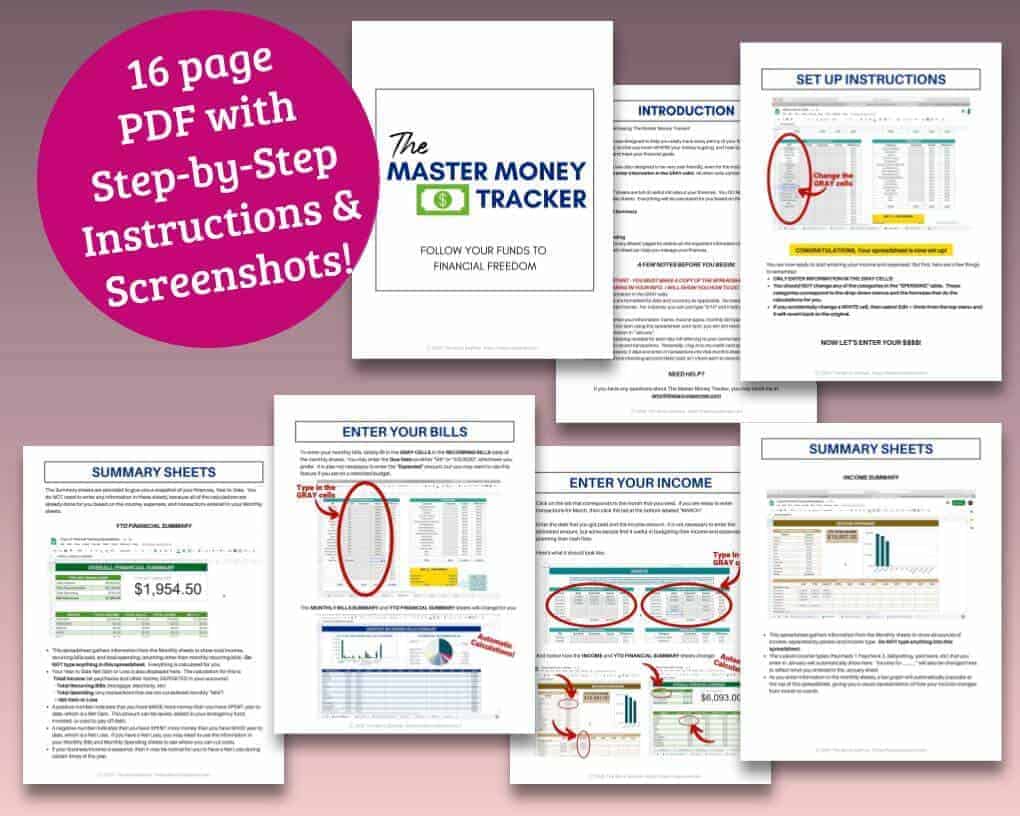

How to Use My Money Tracking Template

As I mentioned above, the budget tracker spreadsheet is super easy to use, and it includes a 16 page PDF of detailed instructions with screen shots… So if you can read step-by-step instructions, then you’ll have no problem setting up your spreadsheet and using it to track your income and expenses.

Here are some of the basic steps for how the money tracker spreadsheet works:

Step 1: Personalize the sheet with your name and income categories.

First, add your names to the two income tables at the top of the January sheet. You can click on the cell (box) that says “Income for _______” and replace the line with your name. There are two income tables so you can keep track of both yours and your spouse’s income separately.

You can also change the Income names (Paycheck 1, Paycheck 2, etc) on the January sheet to personalize them to fit your needs. For instance, change Paycheck 5 to Alimony Payment.

Whatever changes that you make on the January sheet will automatically transfer to the income tables in all of the other monthly sheets, so I recommend that you keep 1-2 miscellaneous income fields, like the “Other Income” cells that are already included.

Step 2: Enter your monthly bill types or names.

Next, find the table in the January sheet that’s labeled “Recurring Bills”. This is where you’ll enter bills that you have each month, like your mortgage payment, electricity payment, and car insurance.

You’ll need to make the changes on the January sheet when setting up your spreadsheet, and the personalized monthly bills that you enter there will automatically change on the other months also.

In the screenshot above, you can see that I changed “Car Payment 2” to “Honda Payment”.

The utilities are in WHITE cells, meaning that you SHOULD NOT change them. If you do not have a particular type of utility, you can just leave it blank.

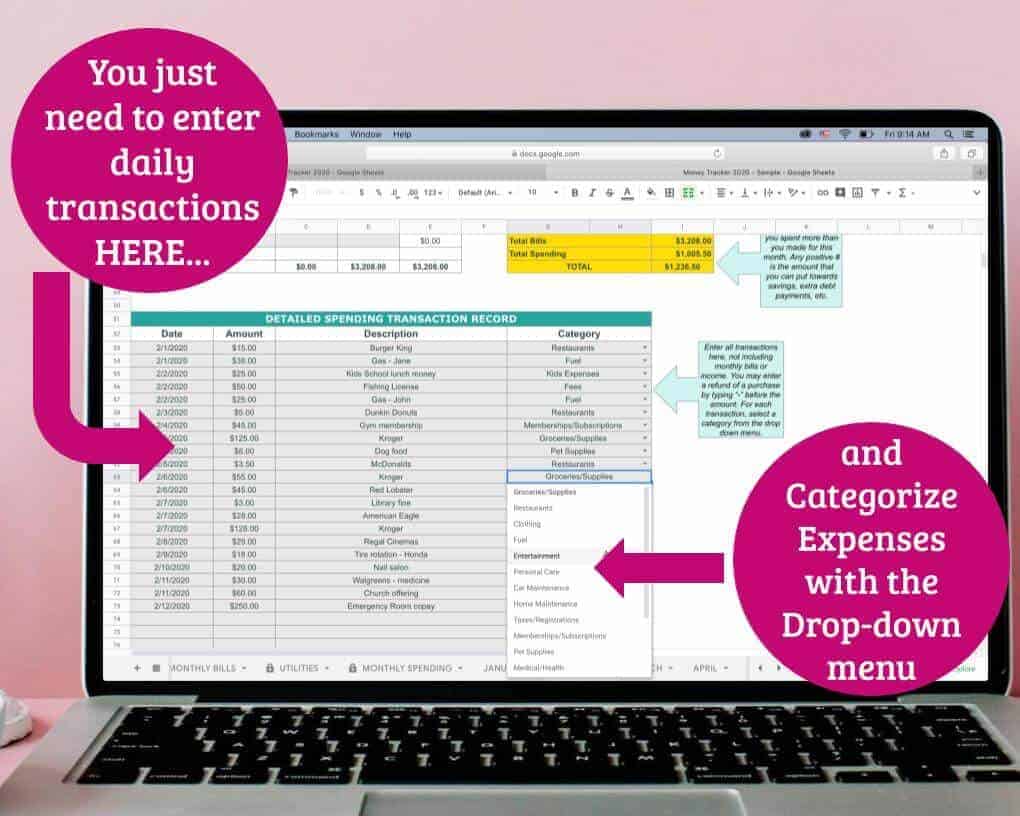

Step 3: Enter in all transactions each day.

After you’ve personalized the income types and the names of your monthly bills, you’re ready to start using the money tracker spreadsheet!

Find the January sheet, or the correct monthly sheet if you’re starting to track your finances in the middle of the year, and enter each transaction.

If a transaction is a monthly bill, then you’ll enter it in the bills table. If the amount is a regular spending transaction, then you’ll enter it in the spending table.

To enter your monthly bills, simply fill in the GRAY CELLS in the RECURRING BILLS table of the monthly sheets. You may enter the Due Date as either “5th” or “3/5/2020”, whichever you prefer. It is also not necessary to enter the “Expected” amount, but you may want to use this feature if you are on a restricted budget.

All other transactions that are NOT income or recurring monthly bills go in the table at the bottom of each monthly sheet.

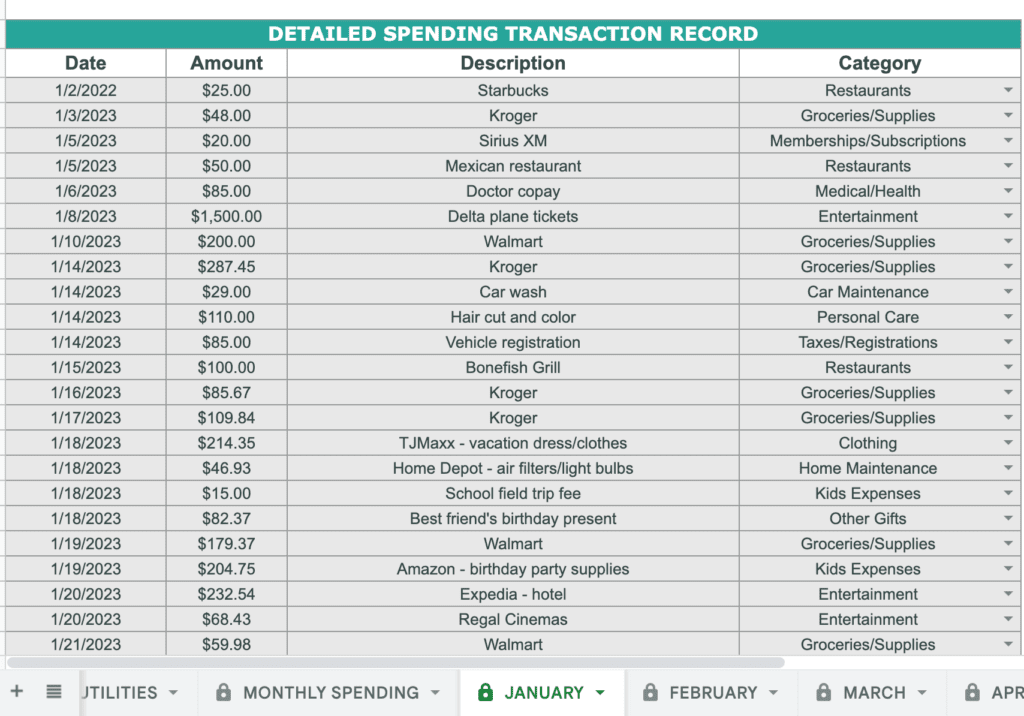

Here are some sample transactions entered into a monthly sheet so you can see how it works:

For each transaction, you’ll enter the date, the dollar amount, and a description of the charge. Then, click on the small arrow under the Category column and select the appropriate category from the drop down menu that appears.

And as you enter your spending transactions, you’ll see the changes reflected in the Spending table that looks like this… The categories are totaled up for you automatically:

Get The Master Money Tracker to Track Your Spending

Of ALL of the products that I’ve created to help with household management, this money tracker spreadsheet is one of my favorites! Along with my super popular Emergency Binder!

If you think that this spreadsheet is just what you need to get your finances on track, then you can check it out in my shop!

You’ll get the link to the Google Sheets spreadsheet that I personally use and LOVE, plus a detailed 16 page PDF of instructions with screenshots to help you!

See The Master Money Tracker Spreadsheet in my Shop HERE!

FAQ’s About the Money Tracker Spreadsheet

If you’ve never kept track of your finances with a spreadsheet, then you may have some more questions. Here are some of the frequently asked questions that I get from my customers about The Master Money Tracker:

Where is the spreadsheet link? I only received a PDF file?

The actual link to the spreadsheet appears on page 8 of the PDF instructions… It’s the first step under the “Set Up Instructions”.

How do I edit the spreadsheet? It says that I have to get permission to make changes?

The spreadsheet is delivered in “View only” mode, meaning that you can’t make any changes to that copy. This protects the sheet from being changed by others. You will need to sign in to your Google account to make a copy of the spreadsheet before you enter in your information. You will not be able to enter any info into this sheet in View only mode.

Here’s how to make a copy so that you can enter in your info:

- Select File > Make a copy from the upper menu.

- Change the name of the copied spreadsheet to whatever you like. I change mine to “Money Tracker” and then the year… That way I can go back and reference previous year’s sheets if I want to know how our income and expenses compare.

- You now have a private copy of the spreadsheet and you’re ready to start entering in your information.

Does the money tracker spreadsheet work in Excel?

Unfortunately, no. There are some very advanced formulas that are included in the template, and they do not work properly in Microsoft Excel.

Do I have to repurchase the spreadsheet every year?

Nope! You can use it year after year!

I recommend that you save multiple copies of the spreadsheet to your Google Drive account first thing. You can just select “Make a Copy” from the File menu, make extra copies, and name each copy with the year (like Money Tracker 2023, Money Tracker 2024, etc.). Then, you have a new copy of the spreadsheet to start fresh for each new year.

Isn’t it time consuming to type in every single transaction for each month?

For me, it’s not overwhelming at all… It’s just a part of my routine. Usually it only takes me about 15 minutes to go through and update everything once every 2-3 days.

I sit at my desk and do it while I’m having my morning coffee, and at the same time since I’m already on my credit card apps, I go ahead and pay off all 3 of our credit cards every 7 days – that way I’m never paying interest, and I kill two birds with one stone so to speak.

Wouldn’t a budgeting app be easier?

Many of the budgeting apps are connected to your bank account or credit card, which is why I prefer to use my spreadsheet method. I’m not saying that those apps are insecure, but I personally don’t like the idea of having to input my financial account numbers into an app, even though it may be easier because all of the transactions are inputted into the app automatically.

The important thing is that you find what works best for you and your family, and you stick with it to make actively managing your finances part of your routine.

This Google Sheets Budget Template Changed My Finances

This spreadsheet to track personal expenses and income is one of my absolute FAVORITE ways to stay on top of our personal finances. Not only is it super motivating to watch our Net Gain (savings) go up every month, but I also feel like I have a much better picture of our financial health.

When my husband and I first got married over 16 years ago, we were spending more money than we made without even realizing it! But with the help of this personal finances tracker, I know where our money is going and where we need to cut back to stay on track.

And remember this:

Knowledge is Power! By taking a few extra minutes each day to KNOW where your money is going, you will have the POWER to make more informed financial decisions.

And if you want some other tips for managing your finances, check out some of these posts:

- Free Bill Tracker Printable PDF – Great if you’re wanting a pen and paper solution for tracking your monthly bills!

- How to Do a No Spend Challenge (and 10 tips to stick with it!) – Grab some free printable challenge trackers to keep you on target!

Comments & Reviews

I have a Google sheet to track payment dates, but it’s not detailed and little spending falls through the cracks. Excited to start using this! Plus is, it’s not going to break the bank at this low cost! Thanks!

Hi Jennifer! Yes, this spreadsheet is a game changer! And once you get in the routine of entering all of your transactions from your bank app or credit card app every few days, it’s really easy to use and keep up with… I actually just got my parents started using it yesterday since it’s the start of a new year. My Dad used to keep track of everything on paper each month, but then he would have to go back and add everything up by hand… this is SO much easier! Hope you love it as much as I do! 🙂