Want to do a No Spend Challenge, but have no idea where to start? Learn how to do a No Spend Challenge and get easy tips to help you stick with it, whether you’re doing a no spend week or a no spend month!

Did you know that over half of Americans spend as much or MORE money than they make?

That statistic is frightening, I know…

And when we first got married, my husband and I fell into that category, and we didn’t even know it!

We were fortunate enough to have a decent amount of money in the bank, but each month we would spend just a little bit more than we made, so slowly that bank balance started to dwindle. The ever-so-slight decrease wasn’t really noticeable, which is why it’s so easy to spend more money than you earn without realizing it.

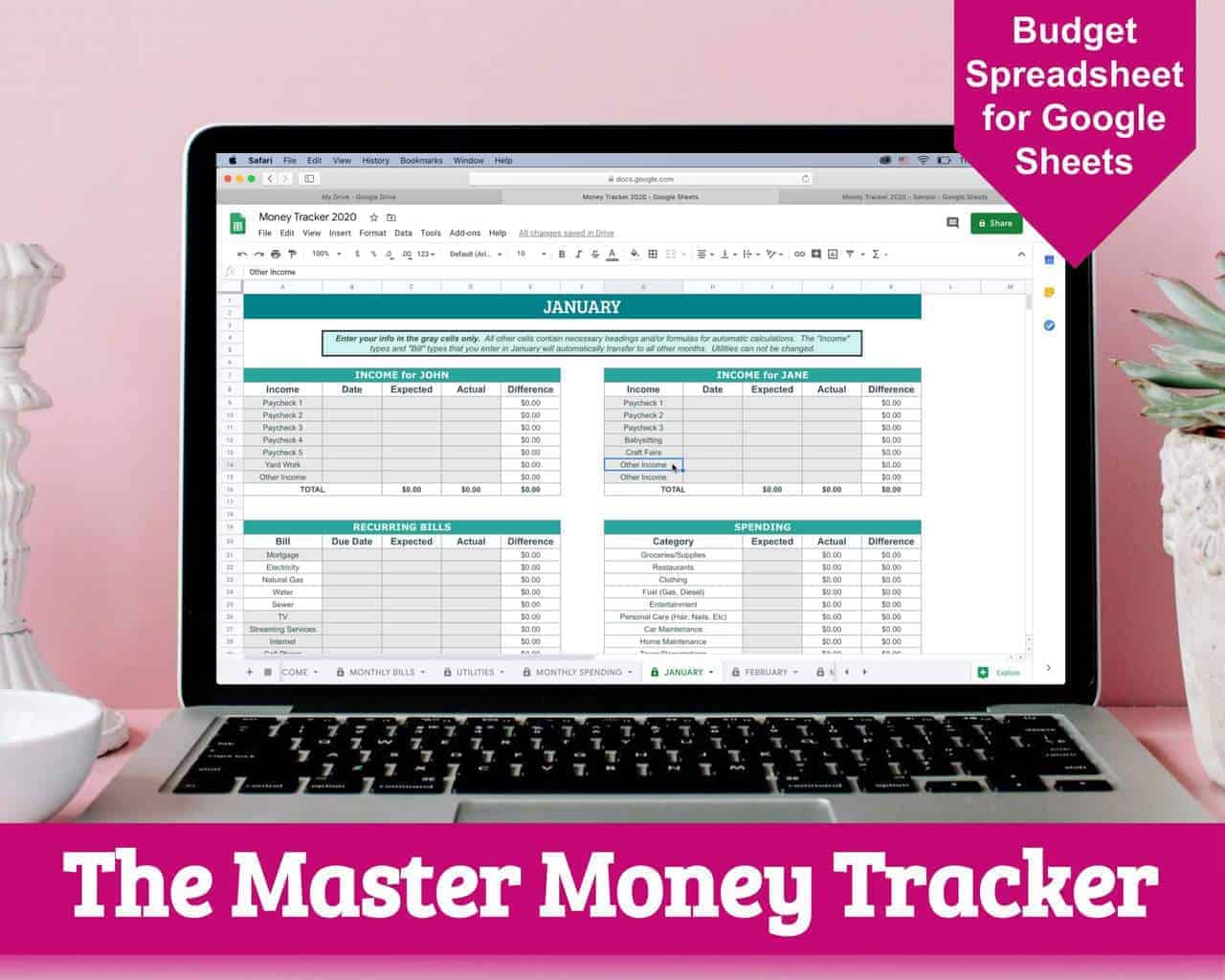

Now, we use this awesome Budget Spreadsheet to keep track of every single penny, and I know exactly how much money we are saving each month! If you don’t currently have a favorite method that you’re using to track your expenses and income, then I highly recommend this budget spreadsheet system!

And when I notice that our spending is starting to creep back up again, we do a mini 30 day No Spend Challenge to get our finances back in check. A No Spend Challenge doesn’t have to be difficult or stressful, and it doesn’t have to last for 30 days or even 2 weeks. You make the rules and set the goal for your own No Spend Challenge so that it’s actually doable for YOU!

If you feel like your wallet needs a cool-off period too, then here’s how to do a No Spend Challenge and actually be successful at it!

What is a No Spend Challenge?

Simply put, a No Spend Challenge is when you challenge yourself to stop spending money on things that are unnecessary, like the impulse candy bar that you throw in your cart in the checkout line or the new sweatshirt that you buy just because it’s on sale.

With a No Spend Challenge, YOU make the rules. So you can:

- Stop spending money COMPLETELY for a set period of time – Obviously this would require that you have a good stock of food and that any bills that may become due in that time frame have already been paid.

- Stop spending money on non-essential items

- Stop spending money on only one or two categories – For instance, stop spending money on eating out at restaurants for 30 days.

Why Should You Do a No Spend Challenge?

Most people are blissfully unaware of the amount of money that they’re spending. And they have no idea that they, too, are included in the half of Americans that spend more than they make.

But a No Spend Challenge, when coupled with a good income and expense tracking system, can help shine light on poor financial habits.

Here are some other reasons WHY you should do a No Spend Challenge:

To Save a Large Amount of Money

Obviously if you cut your non-essential spending completely, you will save a TON of money. But, just how much money can you save by doing a No Spend Challenge?

That will vary depending on your current spending habits, but let’s say that your typical monthly spending looks like this:

- Groceries – $800

- Eating out – $400

- Entertainment – $200

- Clothing – $100

- Miscellaneous personal and household items – $100

Now, imagine that you do a 30 Day No Spend Challenge and cut out anything that’s nonessential (like eating out, entertainment, clothing and miscellaneous items), AND you eat foods that you already have in your fridge and pantry, cutting your grocery bill for the month in half…

That’s a savings of $1,200 in ONE MONTH!

To Break Poor Spending Habits

I had a bad habit of getting iced coffees at the drive-thru down the street. Probably 4 mornings a week, I would fork over $2.80 for a coffee that I could make at home for about 40 cents. But once I did a No Spend Month, it helped me to nix that bad spending habit and save about $50 a month, just on coffee.

A No Spend Challenge can help you get in the habit of NOT spending money on certain vices.

To Reduce Your Debt

You can only spend more money than you make by: 1) Taking money from your savings or 2) Taking on more debt.

So if you’re in the habit of using credit cards for the majority of your spending, and then you don’t pay them off completely at the end of every month, then you’re adding to your debt load.

A No Spend Challenge can help you spend less money on your credit cards, and you can use part of your savings from your no spend month to pay down your debt balances.

How to Do a No Spend Challenge

A No Spend Challenge is actually quite simple, and the financial benefits can be HUGE! Here’s how to do a No Spend Challenge of your own:

Determine the time frame for your No Spend Challenge.

A goal is much easier to reach if it 1) is realistic and 2) has a finality element to it. In other words, there needs to be an “end in sight”.

The first step to a successful No Spend Challenge is to set the specific number of days or weeks that you won’t spend any unnecessary money. You could choose any time period that you feel like will work for you, whether it be one week or one month.

I will caution you, however, against trying for a No Spend Challenge that lasts longer than 30 days, especially if you’re new to the concept. You may start to feel like you’re depriving yourself, which could lead to a big spending binge.

If you’re new to the “no spend” concept, then you can start off with a one week or 15 day No Spend Challenge, or dive right in to a no spend month if you feel like you’re fully prepared (like you have a fully stocked freezer and there are no major holidays coming up).

Think about spending categories that you will cut out.

When you’re preparing to do a no spend challenge, you need to decide what spending is necessary and what things you can do without.

Obviously, you’ll still need to pay your monthly bills and buy groceries (you’re not trying to hurt your credit score or starve!)… but do you really need that new lipstick when you have 5 other tubes in your drawer? And is it really necessary to grab take-out for dinner when you’ve got a refrigerator full of leftovers… although my husband would argue yes to that one (he despises leftovers!).

Here are some common things that you’re probably spending money on that you don’t really NEED:

- Coffee shop coffee – This one is my budgeting vice!

- Eating out at restaurants

- Buying lunch from a restaurant everyday instead of making it at home

- Impulse grocery store buys

- Clothing

- Beauty products or toiletries that you already have

- Shoes

- Seasonal home decor items

- Paying for movie rentals when you already have a streaming service

- Entertainment expenses like miniature golf and movie theater outings

- Buying books that you can check out for free from the library

- Personal care services like manicures and hair coloring

- Gas station snacks

- Late fees

Set savings goals for your No Spend Challenge.

Do you want to save $1,000 in one month? It may sound impossible, but most families probably spend more than that each month on unnecessary items.

It’s important to set REALISTIC savings goals for your no spend time to help propel you forward. That means, if you make $5,000 per month and your mortgage and monthly bills are $2,000 per month, then it is unrealistic to set a savings goal of $4,000 for your no spend month.

Track your progress.

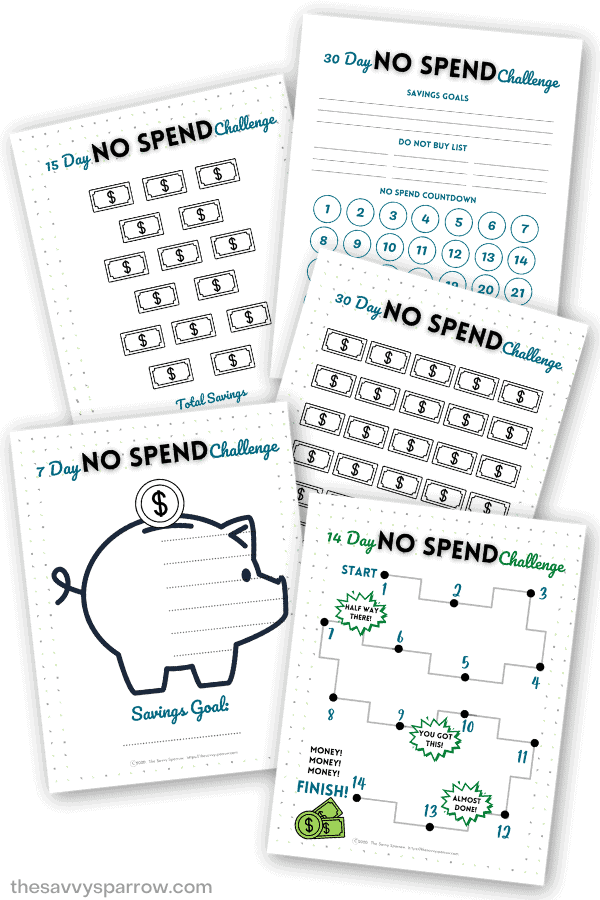

Use a calendar, your planner or a free printable No Spend Challenge worksheet to track your progress. You can either:

- Cross off each day on a calendar. – This also helps you to see that there is an end in sight, which can be motivation to keep going.

- Color in money or piggy bank symbols in a bullet journal for each day that you don’t spend any money.

- Keep track of actual dollar amounts that you are saving on a savings tracker worksheet.

- Use a free printable No Spend Challenge worksheet to track your progress. You can grab my free printable worksheets at the end of this post!

11 Tips for a Successful No Spend Month

Tip 1: Give yourself some grace!

Going for an extended period of time without spending money is HARD, especially if you have kids. Field trips pop up, or your kids get invited to a birthday party, or you have to run to the drug store to pick up cough medicine.

Don’t deny yourself the necessities that are sure to come up during your No Spend Challenge. And DON’T BE TOO HARD ON YOURSELF when you need to spend money!

Realize that there will be some things that are absolute must-have’s that you will need to spend money on, even if they weren’t planned purchases and those expenditures aren’t included in your monthly bills. So purchase those necessary items, and then go right back to SAVING.

Tip 2: If you mess up one day, don’t use it as an excuse to binge spend!

Just because you fall off the no spend wagon for one day, doesn’t mean you need to completely jump ship… yes, I realize I’ve got two different vehicle metaphors there. 🙂

If you give in to a Starbucks coffee craving, don’t follow that up with a trip to TJ Maxx, since you’ve already blown your no spend day anyway.

Tip 3: Focus on the end goal.

Is there something that you’re saving for? Do you want to pay off your credit card debt or take a nice vacation or pay cash for your daughter’s braces?

Rather than focusing on the things that you’re giving up (like your Caramel Macchiatos), focus on what you’ll be gaining from doing a No Spend Challenge, like awesome memories from your upcoming vacation or freedom from your credit card debt.

You could even print out a photo that represents whatever you’re saving for and hang it on your bathroom mirror for daily motivation.

Tip 4: Save your unused gift cards for a “rainy (no spend) day”!

Most people probably have at least one gift card in their wallet that still has money available on it, even if it’s just enough for one coffee drink. A No Spend Month is the PERFECT time to use those gift cards, because you can still purchase the little “luxuries” without actually spending money.

Tip 5: Take advantage of freebies!

A No Spend Challenge isn’t a No FUN Challenge! Just because you’re not spending money on non-essentials, doesn’t mean that you have to sit locked away in your house all day.

You can visit free festivals in your area, or take advantage of other freebies that may be offered during your No Spend Challenge time frame. For instance, there are a TON of awesome freebies on random holidays throughout the year, like free coffee and donuts at Krispy Kreme on National Coffee Day and free ice cream cones at Haagen-Daazs on National Ice Cream Day.

You can find a great list of freebies here!

Tip 6: When you have to leave the house, bring water bottles and snacks.

Always have a few snacks and a water bottle in your car or purse, especially if you have kids. Then you won’t need to stop to buy these items and break your no spend goals.

Also, if you know that you will be out running errands for a long period of time or during a meal time, then you may want to pack a small lunch box or cooler with enough food to hold you over until you get home.

Tip 7: Plan your meals at least 24 hours in advance.

The most common reason that we have for breaking our No Spend Challenges is that we forget to prep for dinner.

In fact, just a few hours ago I realized that our chicken breasts would not be thawed in time for tonight’s dinner, and I ended up going to the drive-thru down the street to pick up fried chicken. Way too many calories and 35 DOLLARS later, I’m wishing that I had remembered to thaw the chicken last night instead of this morning, like I did.

ALWAYS have a plan for dinner at least 24 hours in advance, so that you have a chance to thaw meat, prep the slow cooker, etc. If you just leave the dinner plans for the last minute, you’ll probably resort to eating out, which is much more expensive and NOT a necessity.

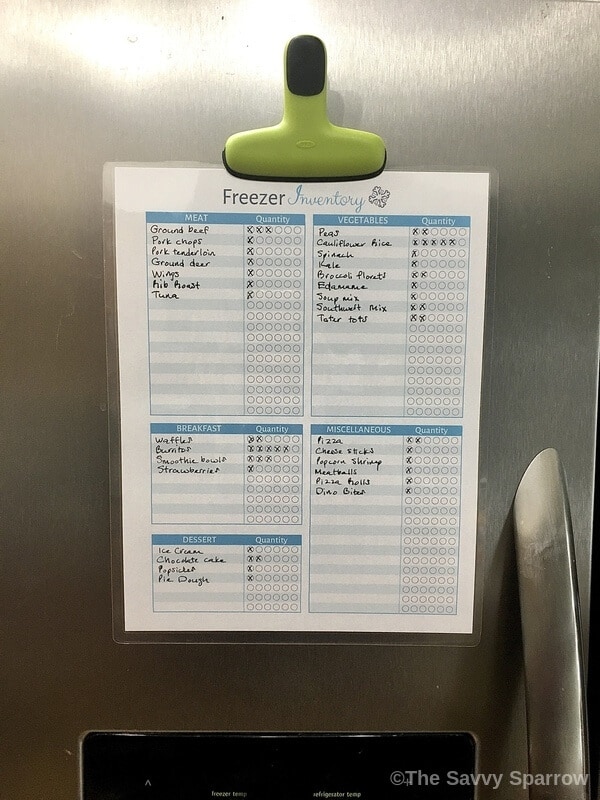

Tip 8: Use your No Spend Challenge time to actually eat the foods you already have!

Raise your hand if you’re guilty of buying a TON of groceries just because there’s a really great sale! I’m really bad at this!

When certain items go on sale for 50% off at my local grocery store, I stock up. I’ve been known to have 15+ bags of cauliflower rice in my freezer at one time, even though it takes us well over 2 months to go through that much, and in that time frame there will be another 50% off sale.

So, our freezer and pantry are often overflowing.

A No Spend Challenge is the PERFECT time to use up the foods that you already have on hand, so that they don’t go bad and so that you can save all of that extra money on groceries.

In preparation for your no spend month, you can even organize your freezer with a free printable Freezer Inventory Sheet, so that it’s easier to plan meals.

Tip 9: Get into the habit of tracking income and expenses while you’re doing your No Spend Challenge.

There’s no greater feeling than knowing that you’ve saved over $1,000 in just one month… but you’ll never know how much you’re saving unless you have a good system in place to actually TRACK your income and spending.

By the way, if you’re completely LOST when it comes to tracking your finances, then you NEED to check out this post: How to Keep Track of Expenses and Income – 9 Tips You Need to Hear!

And once you know EXACTLY how much you’re saving, you’ll be motivated to keep going, and even do multiple no spend challenges throughout the year, because…

“Success breeds success”.

Mia Hamm

In other words, once you SEE that you’re successful at something (like sticking to a no spend challenge and saving a LOAD of money), you’ll be more motivated to do it again, and be successful at it again.

Not currently tracking your income and spending???

I have used this Budget Spreadsheet for over a year, and I HIGHLY recommend it! You simply type in ALL of your spending transactions each day, the exact amounts of your paychecks and other income, and your monthly bill amounts as you pay them, and the spreadsheet calculates your “Net Gain” or savings for you!

Or, if you’re not really a spreadsheet person, then you can check out this post for How to Track Income and Expenses Using a Weekly Planner. This is how I kept track of EVERY CENT of our spending for over 5 years, before switching to the spreadsheet method!

Tip 10: Don’t start a No Spend Challenge right before a big holiday or major event.

Starting a 30 Day No Spend Challenge on December 1st is just setting yourself up for failure, especially if you have kids or you’ll be hosting guests for Christmas.

Also, back to school time is probably not a great time to put restrictions on your spending, since you’ll be needing to purchase school supplies, clothes, and shoes for your kids.

Be sure that you’re starting your no spend challenge at an optimal time, so that you’re successful!

*Note – Even though you shouldn’t start a no spend month in December, you SHOULD still create a Christmas Budget that works for you!

Tip 11: Make a grocery list before going to the grocery store.

And then actually use it!

One of the most common sources of unnecessary spending, at least for my family, is FOOD. When we go to the grocery store, it’s not uncommon for us to throw a few slices of cake into the buggy. And our waistlines and our wallet can do without that!

I find that I spend much less money at the grocery store when I make a good grocery list before even leaving the house, and then ONLY buy the things that are on that list.

You should also try to go to the grocery store without your kids, if you can, or you can use your store’s curbside pickup service to reduce unnecessary grocery spending.

Free Printable No Spend Challenge Worksheets

Want to grab my free printable No Spend Challenge worksheets?

Just fill out the form below to join my FREE email newsletter, and I’ll send you the password to my ENTIRE freebies library as a gift!

Then you can download and print your No Spend Challenge free worksheets to help you ROCK your own no spend month or week!

Now it’s your turn…

I hope that you’ve seen just HOW MUCH a no spend challenge can help you to save money and to meet your financial goals! Whether you need to save money for Christmas, pay off credit card debt, or you just want to build up a little “cushion” for a rainy day, a No Spend Challenge is a GREAT way to get there.

So, what are you waiting for? Start saving LOADS of money today!

And be sure to check out some of my other posts to help you get your finances under control:

Comments & Reviews

freebies…

thank you very much. I really need this

I have decided to do this for a week…hoping to push 10 days

My rules are simple..

1. Only use what I have at home

2. save what I would have spent on crap

3. Is it a needed or just nice – wait until the 10 days are finished … then is it needed or nice

4. will I benefit for more than 1 month using it

This is really simple but I have to start somewhere 🙂

Hi Penny! I LOVE those ideas! Those are some great questions to ask yourself to determine if you really need to spend money on something… thanks for the tips! 🙂

Thank you

Thank you for all your helpful advice. Im actually excited to start saving.

Hi April! That’s great to hear! Yes, it can be difficult to start, but once you see your savings start to build up in your bank account, you’ll be motivated to keep going! 🙂